salt tax deduction repeal

The so-called SALT deduction was capped at 10000 by former President. When President Trump and Republican majorities in the Senate and the House in 2017 pushed through the 10000 cap on deduction of property taxes and income taxes.

New York Democrats Push Repeal Of Cap On Local Tax Deductions Wsj

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

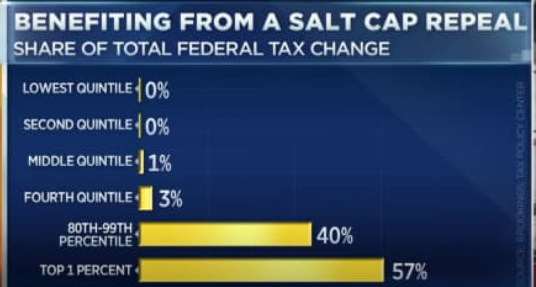

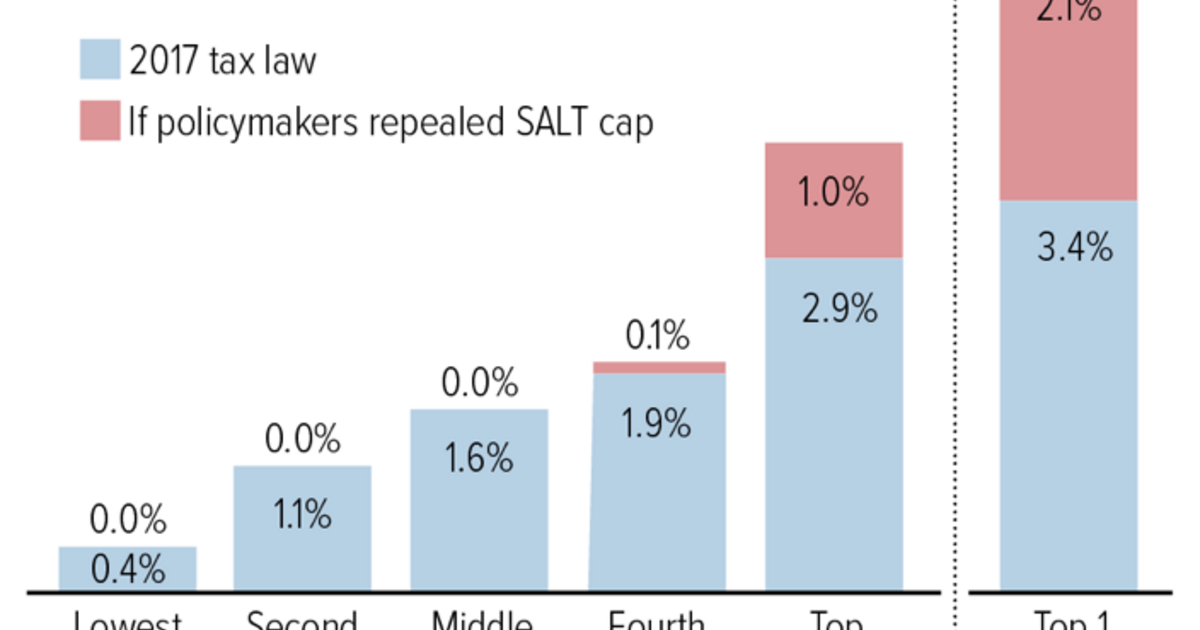

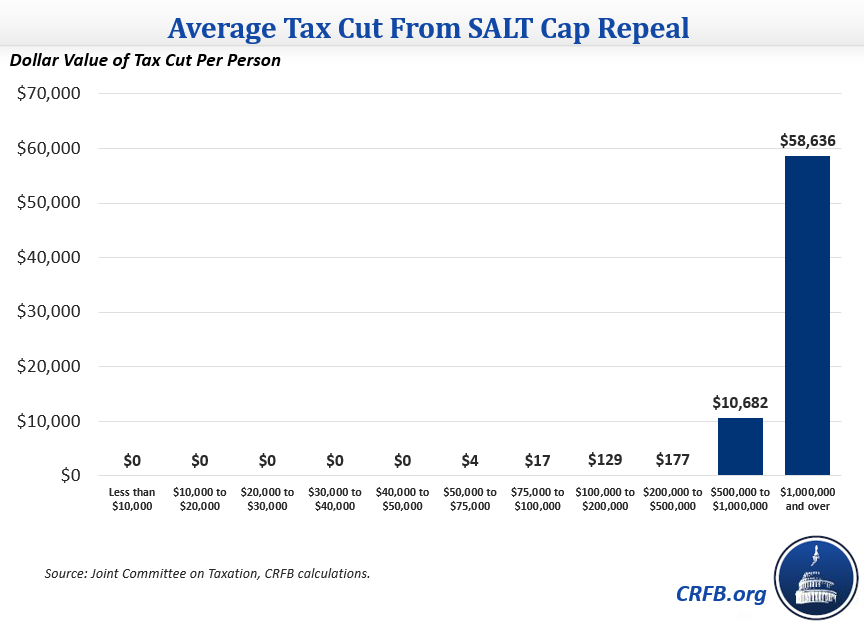

. 11 rows Relaxing State and Local Tax Deduction Cap Would Make Tax Code Less Progressive. The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000. 11 rows If the SALT deduction cap is repealed and the prior-law AMT restored households earning over.

The 43-52 vote Wednesday is a loss for Democrats who have been trying to chip away at the 2017 Republican tax-cut law that limited the federal deduction for state and local. The lawmakers have asked. Tom Suozzi writes For 100 years Americans relied on this deduction Letters.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. Today Senate Minority Leader Charles E. The SALT deduction tends to benefit states with many higher-earners and higher state taxes Joint Committee on Taxation.

Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the partys. The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million.

The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. Schumer and Congressman Tom Suozzi D-Long Island Queens joined together with local families to unveil a plan to fully repeal the. By 2022 the proposed repeal of the SALT cap would mean that the federal government would get about 100 billion less in tax revenue each year.

Democrats consider SALT relief for state and local tax deductions One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about. But 61 percent of all. He is looking for the best way to repeal the SALT deduction cap a Schumer spokesperson said.

According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. WASHINGTON Seven Members of Congress introduced the SALT Deductibility Act bipartisan legislation to restore the full State and Local Tax SALT deduction. The deduction also incentivized states to tax their.

The repeal of the cap is estimated to result. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. It would then be reinstated for five years after that.

One way to offset that cost would be to eliminate the state and local tax SALT deduction which is capped at 10000 through 2025 and tends to benefit higher-earning.

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Black Hispanic Families Would Benefit Less From Salt Cap Repeal

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Democrats Salt Tax Deduction Repeal Would Benefit The Rich Opinion

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

House Votes For Increase And Partial Repeal Of Salt Cap Knowing It S Going Nowhere Don T Mess With Taxes

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

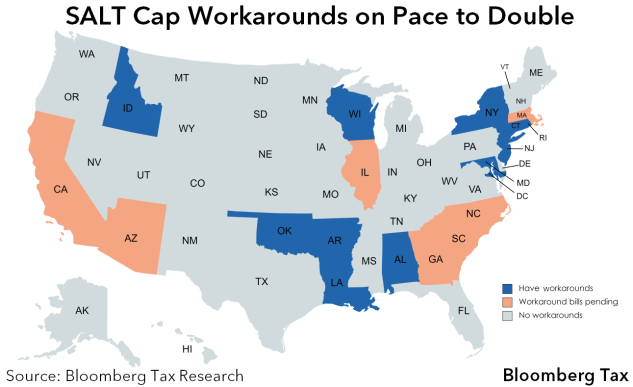

Salt Workarounds Spread To More States As Democrats Seek Repeal

Bernie Sanders Is Mostly Right About The Salt Deduction

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Why Repealing The State And Local Tax Deduction Is So Hard Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_image/image/57880159/GettyImages_452873424.0.jpg)

Tax Bill Salt Deduction Repeal Is Another Blow For Blue State Wealth Curbed

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

How To Deduct State And Local Taxes Above Salt Cap

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget